How to Trade Futures on Bitunix

What is Perpetual Futures Trading?

Bitunix perpetual futures trading, also known as perpetual contracts trading, is a cryptocurrency derivatives trading product offered by Bitunix. The USDT margined perpetual futures is commonly known as the U-Margined Futures, which means that the USDT is used as the denomination currency and also as the settlement currency. A perpetual future is a financial asset trading agreement with a specific crypto asset as the underlying, but without a specific delivery date, and the user can choose to hold the position at all times.

Bitunix perpetual futures support a variety of leverage multiples to meet the needs of different users with different revenue goals. Also, perpetual futures allow users to go long or short, allowing them to make gains in both up and down markets.

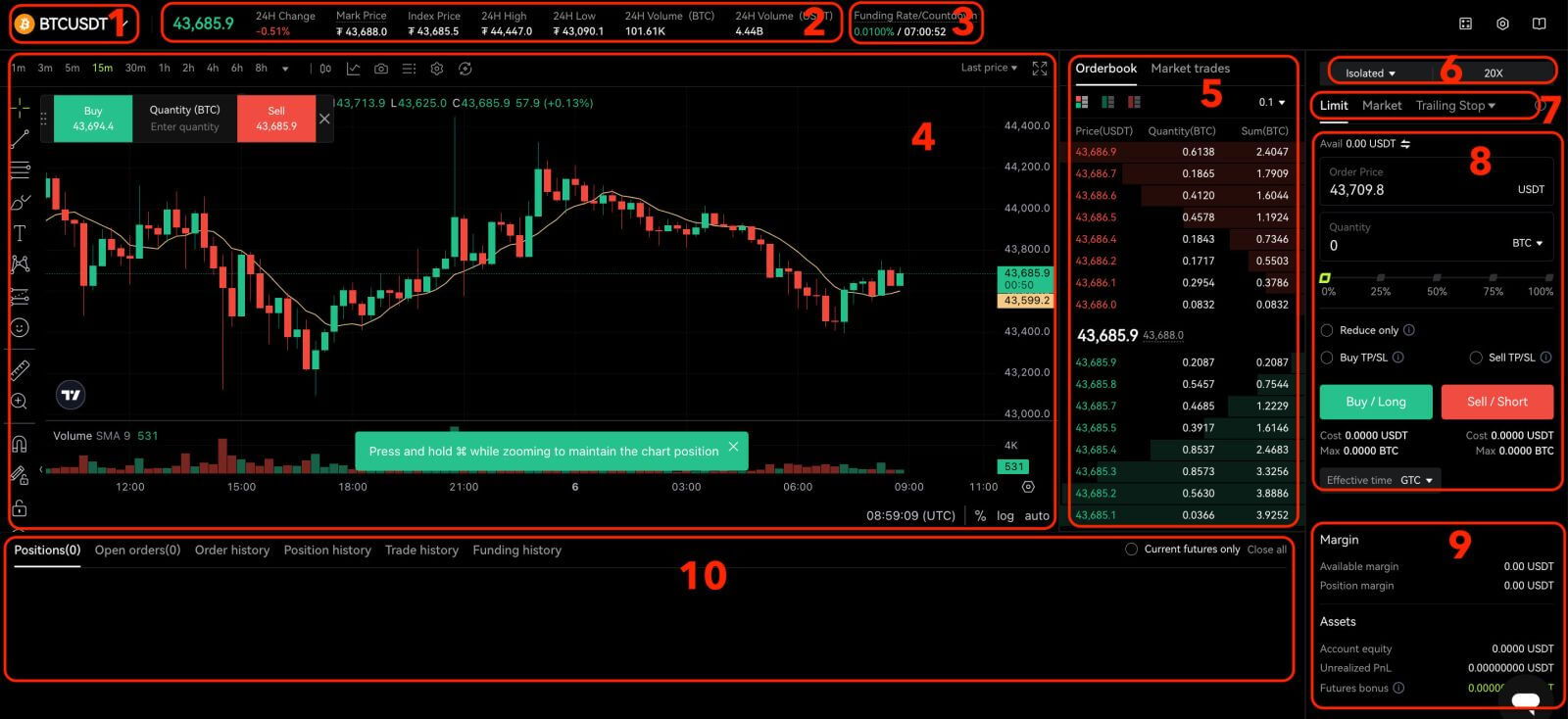

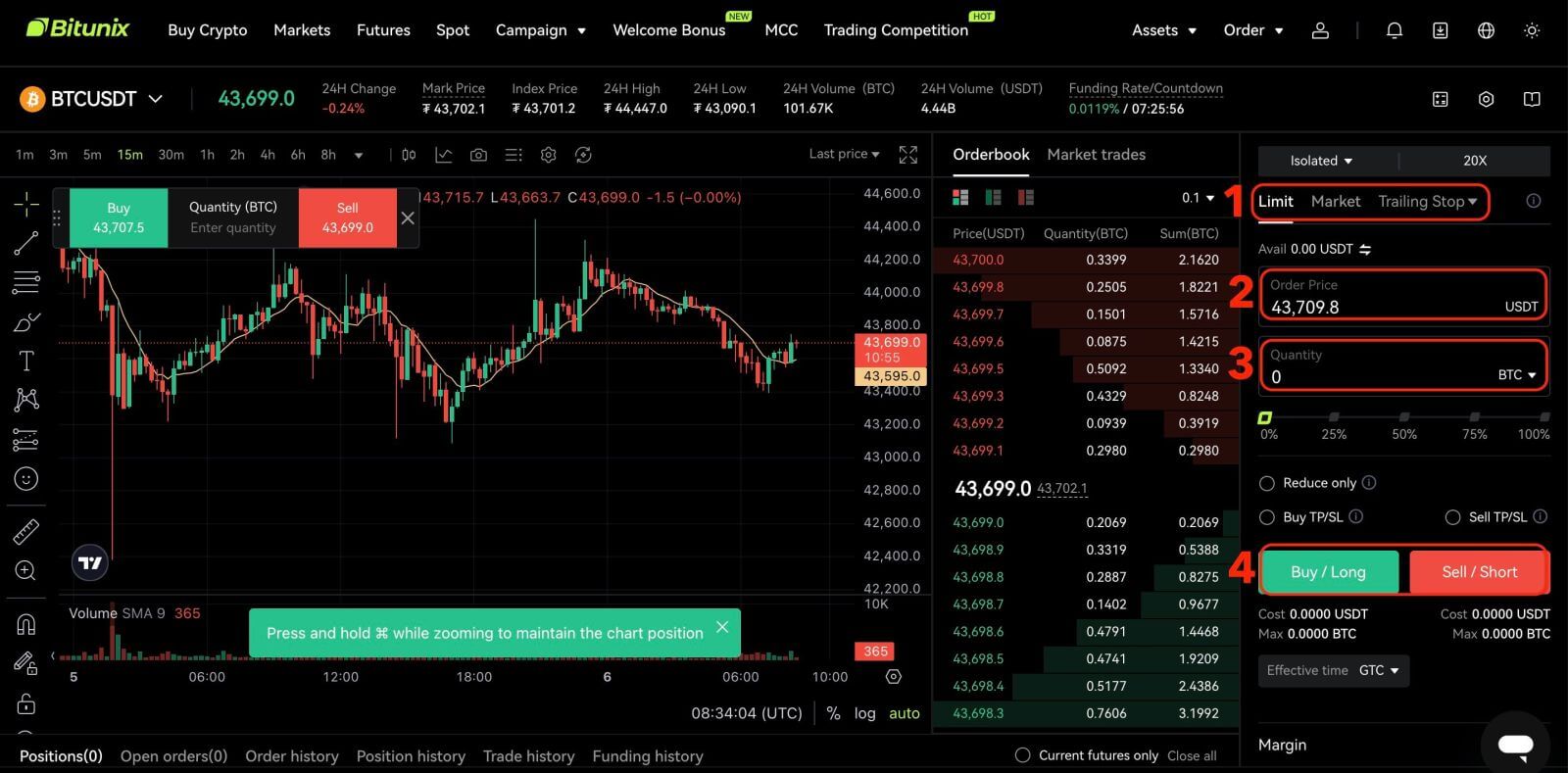

- Trading Pairs: Shows the current contract underlying cryptos. Users can click here to switch to other varieties.

- Trading Data: Current price, highest price, lowest price, increase/decrease rate, and trading volume information within 24 hours.

- Funding Rate: Display the current and next funding rate.

- TradingView Price Trend: K-line chart of the price change of the current trading pair. On the left side, users can click to select drawing tools and indicators for technical analysis.

- Orderbook and Transaction Data: Display current order book order book and real-time transaction order information.

- Position and Leverage: Switching of position mode and leverage multiplier.

- Order type: Users can choose from a limit order, market order and plan order.

- Operation panel: Allow users to make fund transfers and place orders.

- Asset information: Current account’s margin and assets, profit and loss information.

- Position and Order information: Current position, current orders, historical orders and transaction history.

How to Trade USDT-M Perpetual Futures on Bitunix (Web)

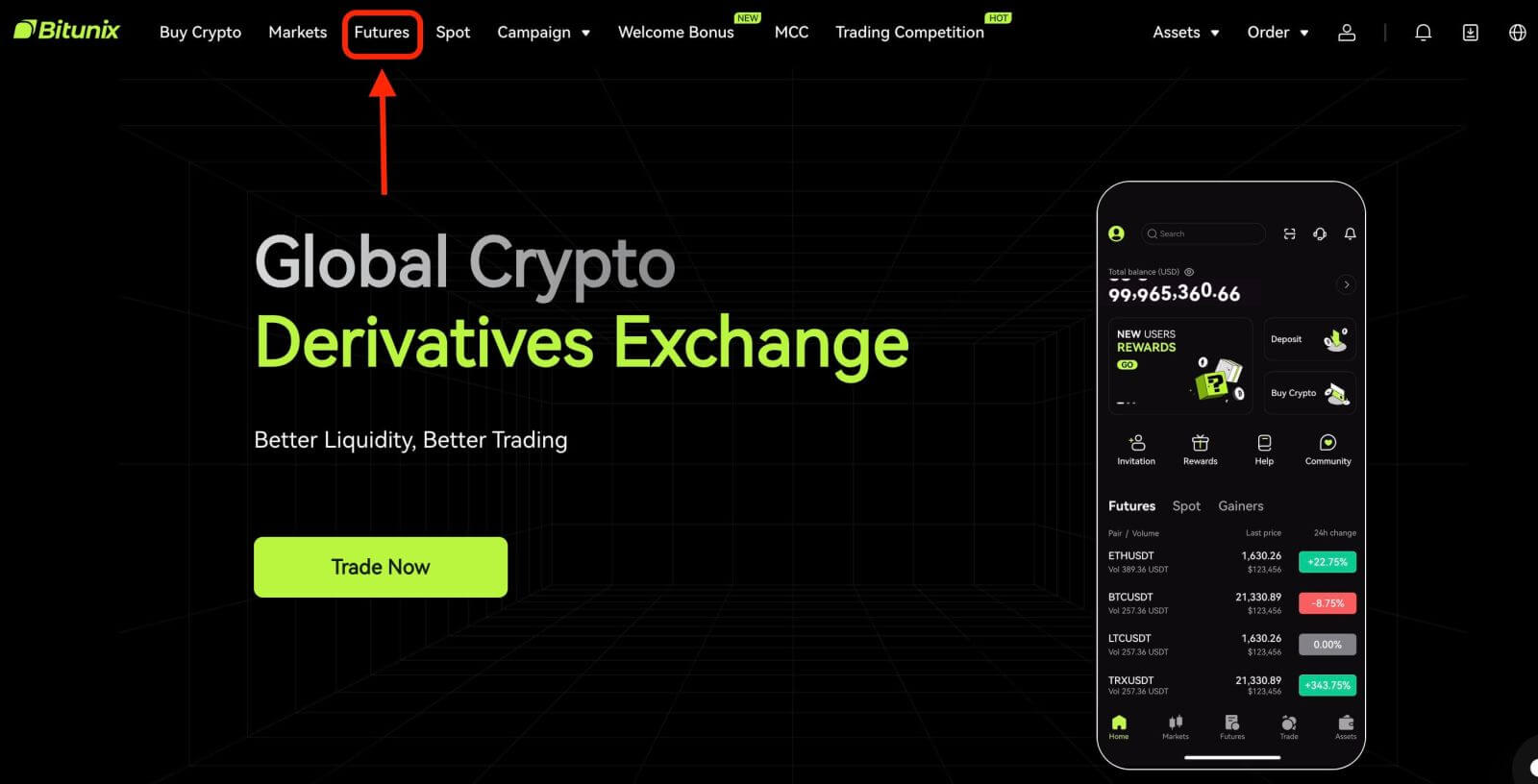

1. Log in to Bitunix website and navigate to the "Futures" section by clicking the tab at the top of the page.

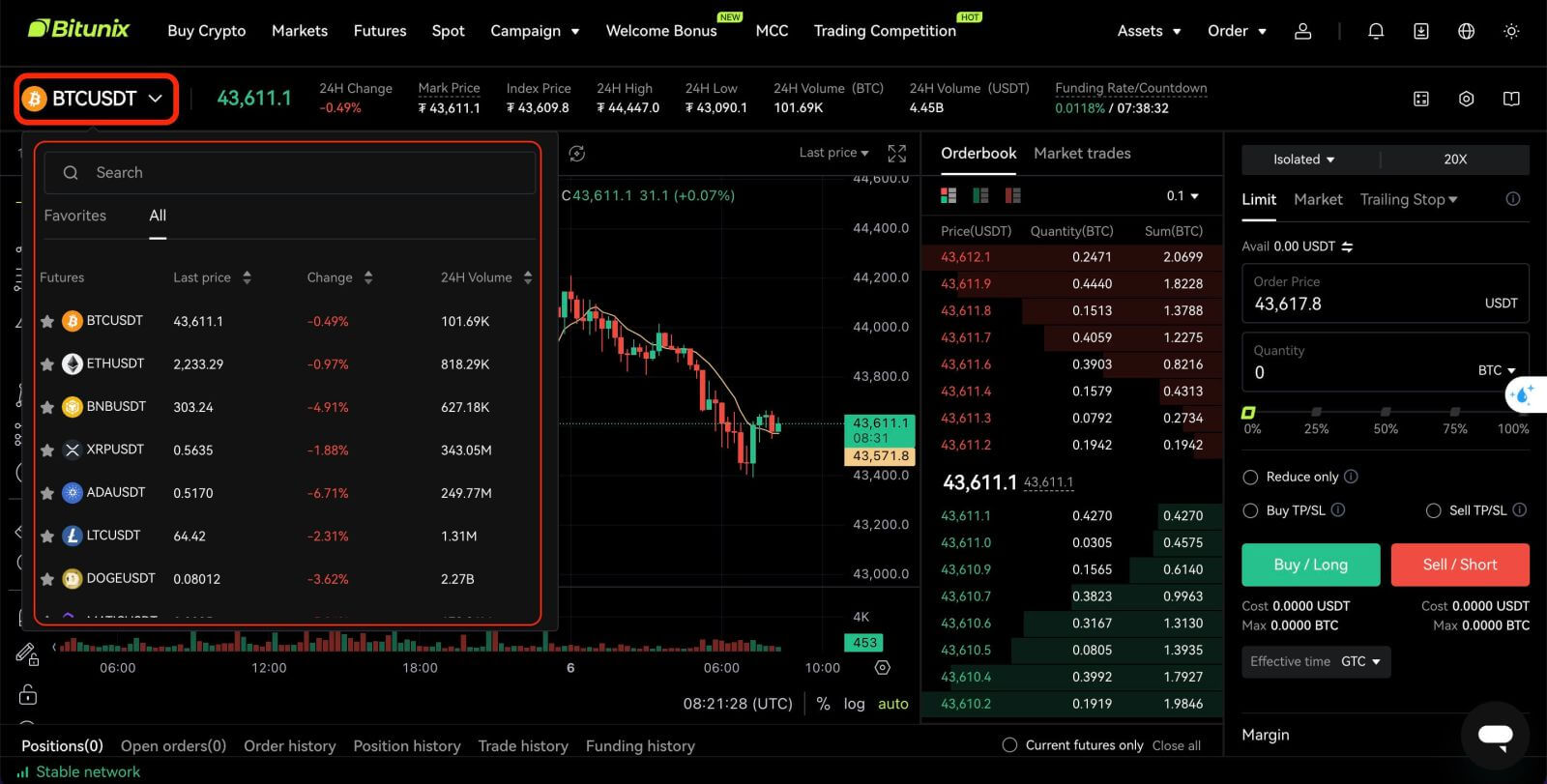

2. On the left-hand side, select BTCUSDT from the list of futures.

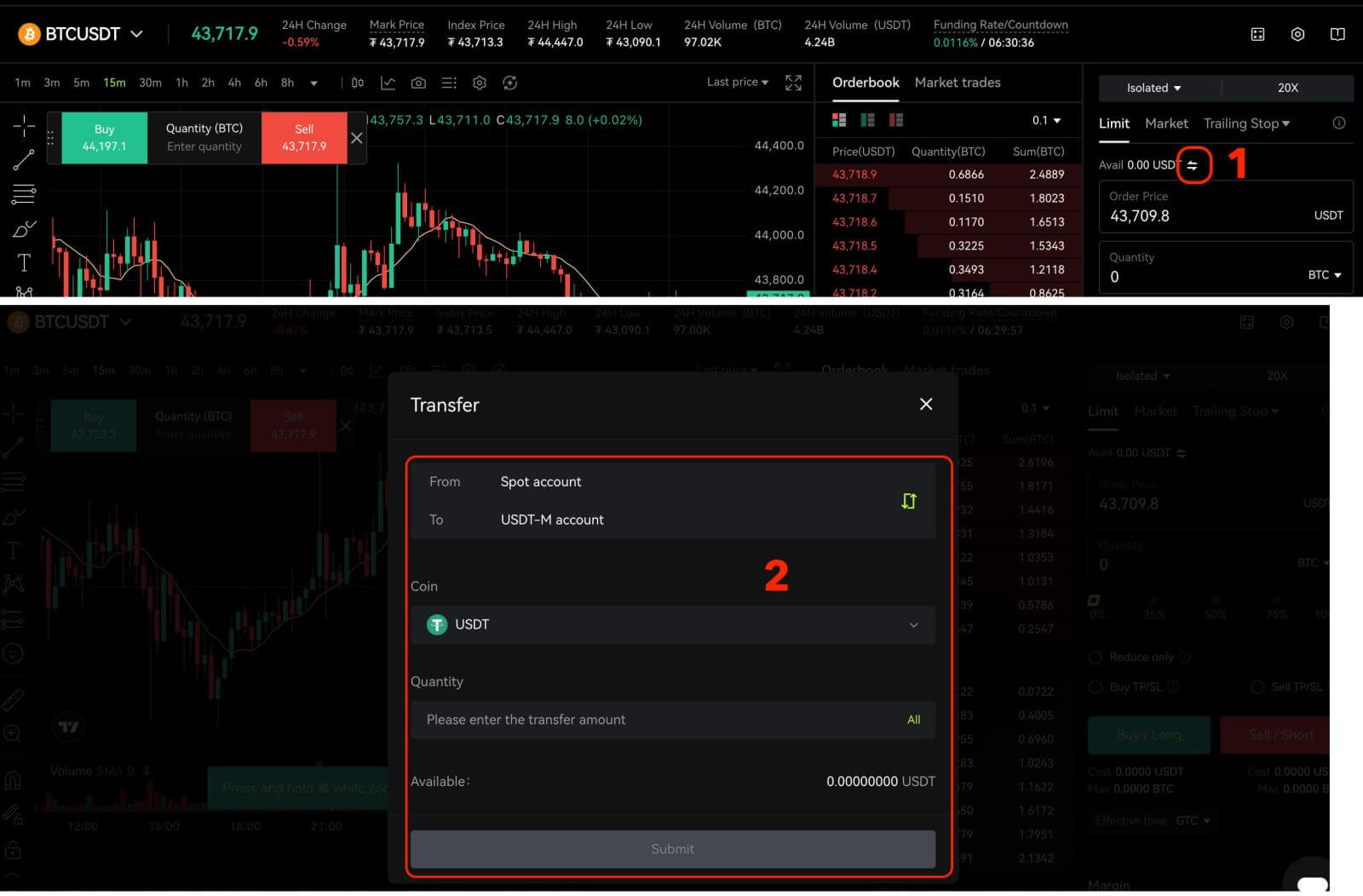

3. Choose "Position by Position" on the right to switch position modes. Adjust the leverage multiplier by clicking on the number. Different products support varying leverage multiples—please check the specific product details for more information.

4. Click the small arrow button on the right to access the transfer menu. Enter the desired amount for transferring funds from the spot account to the futures account and confirm.

5. To open a position, users can choose between three options: Limit Order, Market Order, and Trigger Order. Enter the order price and quantity and click buy.

- Limit Order: Users set the buying or selling price by themselves. The order will only be executed when the market price reaches the set price. If the market price does not reach the set price, the limit order will continue to wait for the transaction in the order book;

- Market Order: Market order refers to the transaction without setting the buying price or selling price. The system will complete the transaction according to the latest market price when placing the order, and the user only needs to enter the amount of the order to be placed.

- Trigger Order: Users are required to set a trigger price, order price and amount. Only when the latest market price reaches the trigger price, the order will be placed as a limit order with the price and amount set before.

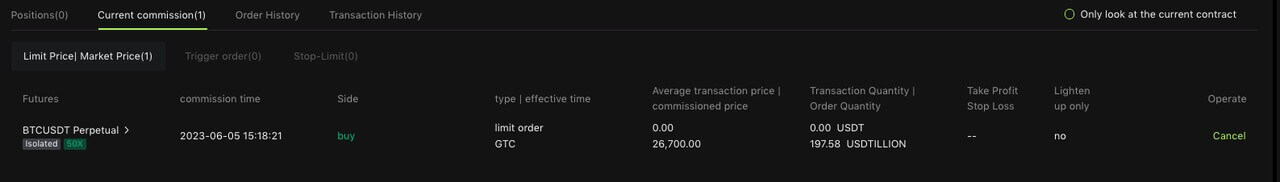

6. After placing your order, view it under "Open Orders" at the bottom of the page. You can cancel orders before they’re filled. Once filled, find them under "Position".

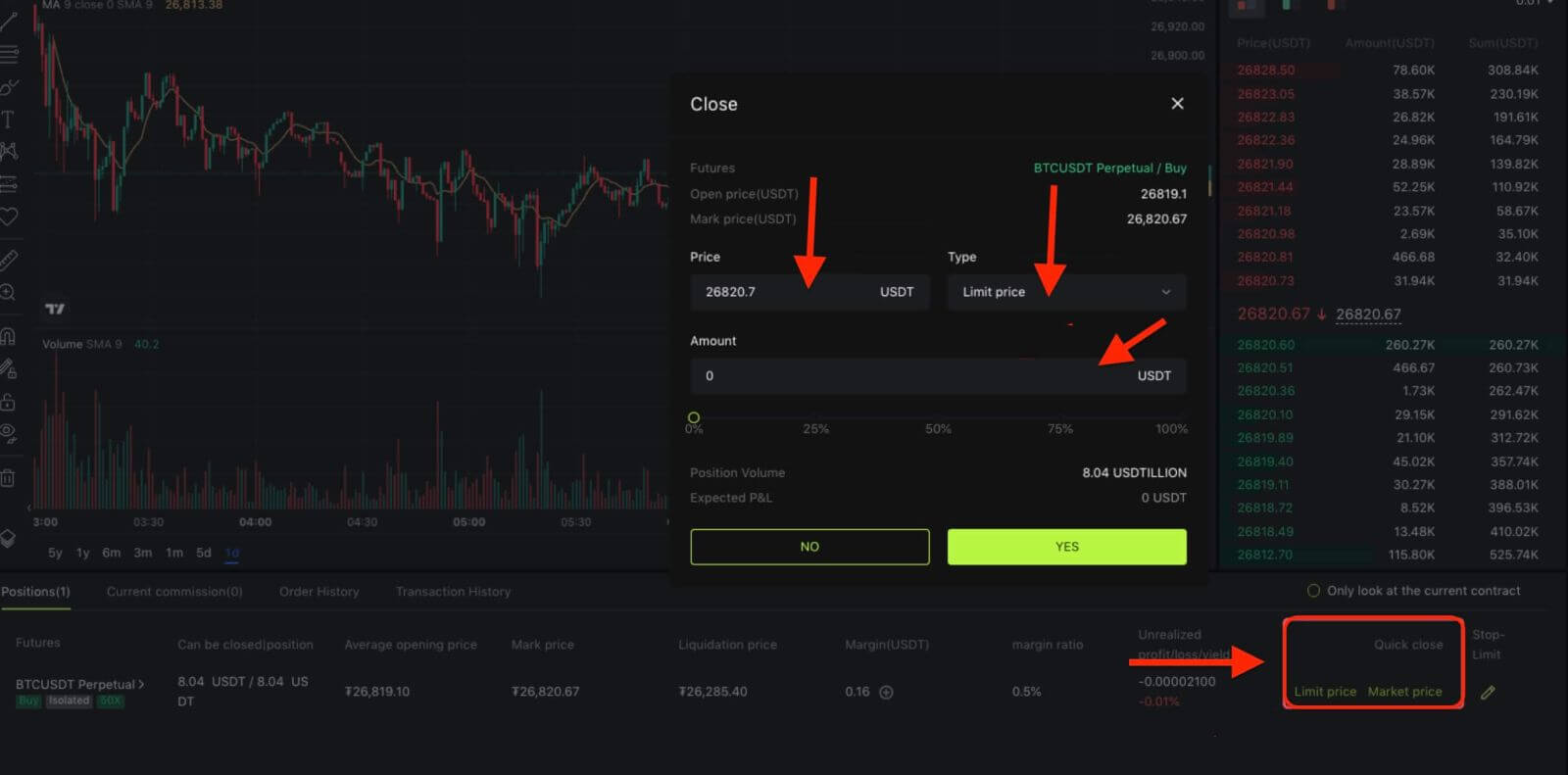

7. To close your position, click "Limit Price" or "Market Price" under your position. Enter the price and amount or only the amount to close your position with a market order.

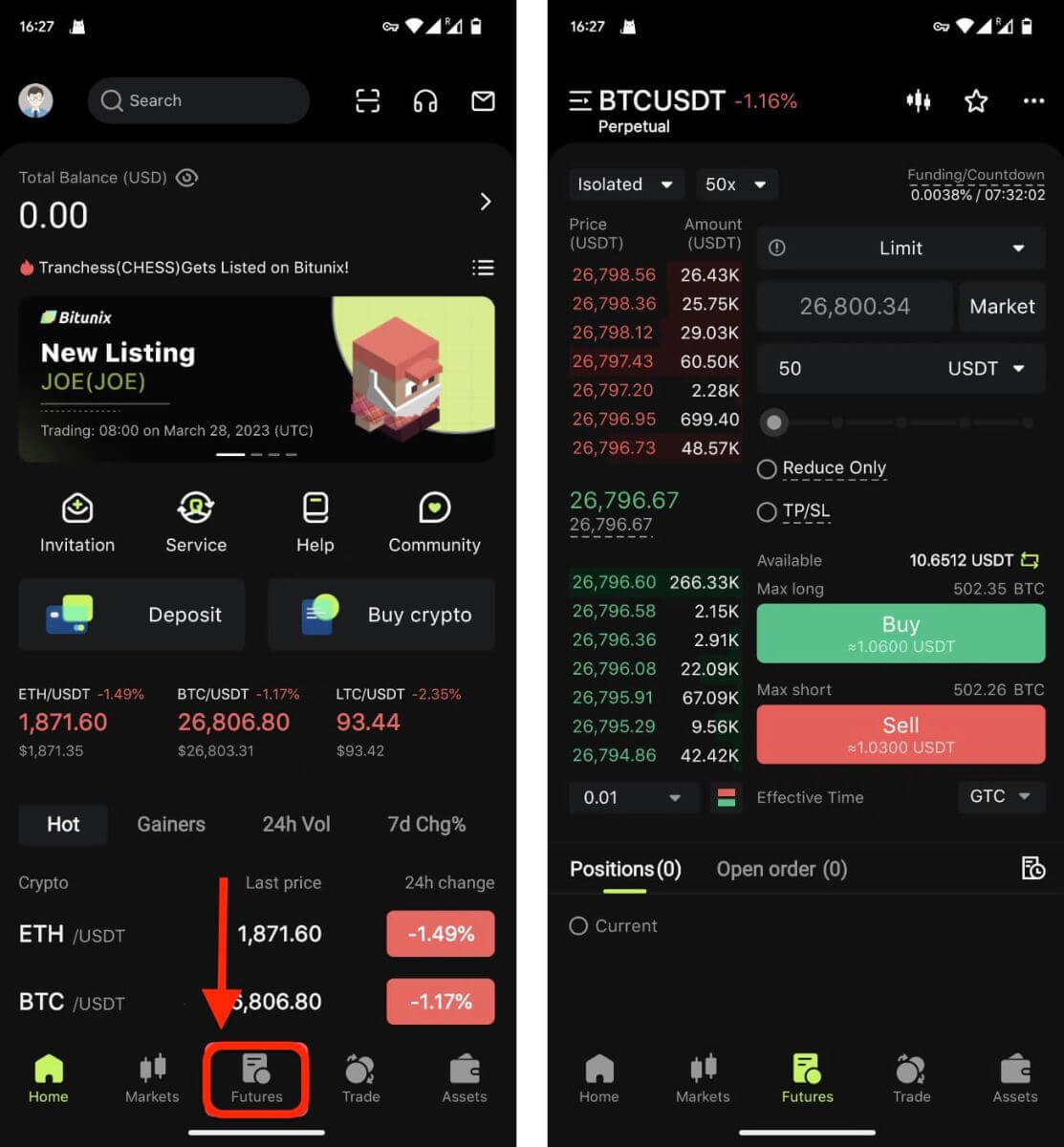

How to Trade USDT-M Perpetual Futures on Bitunix (App)

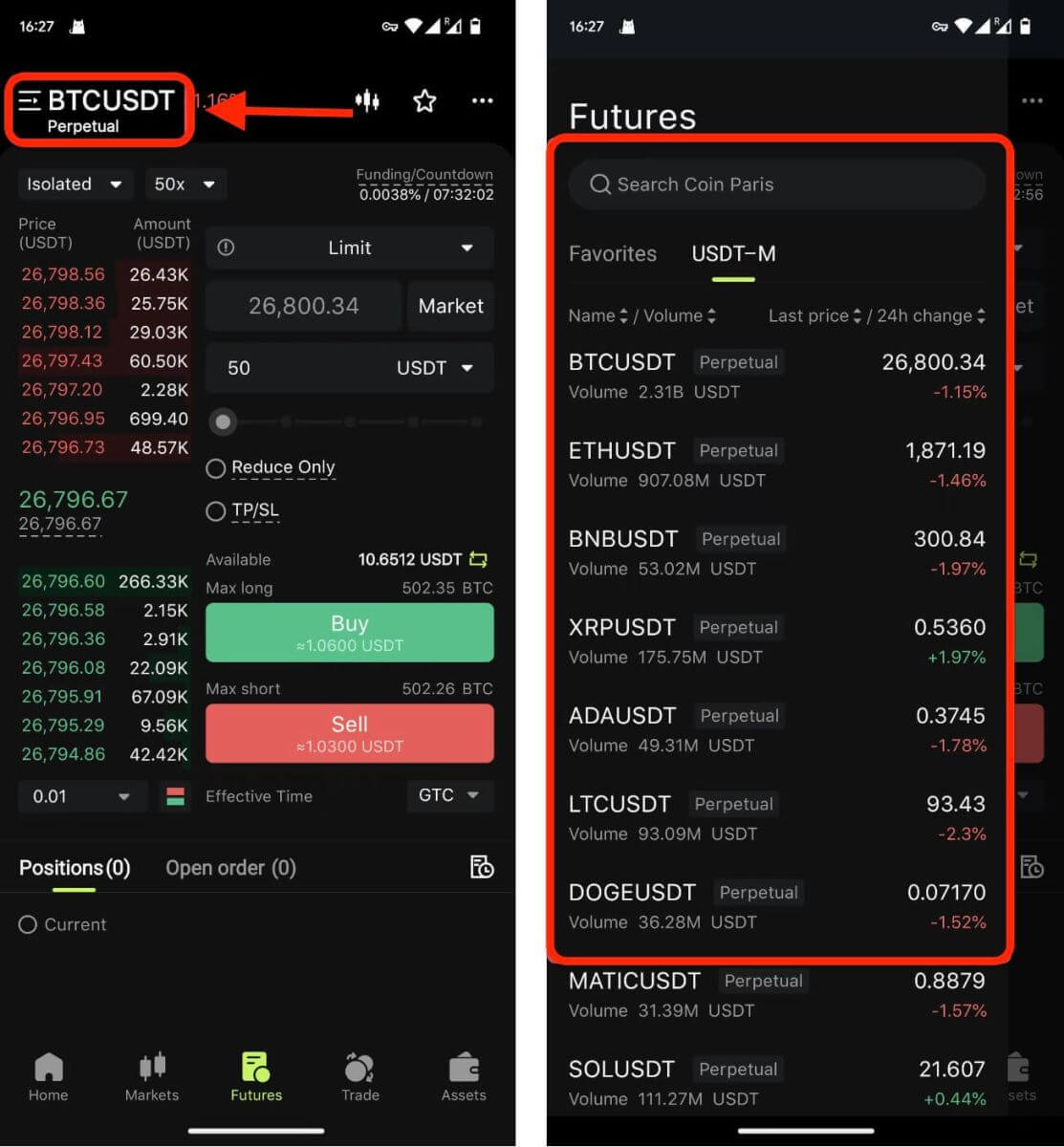

1. Sign in to your Bitunix account using the mobile application and access the "Futures" section located at the bottom of the screen.

2. Tap on BTC/USDT situated at the top left to switch between different trading pairs. Utilize the search bar or directly select from the listed options to find the desired futures for trading.

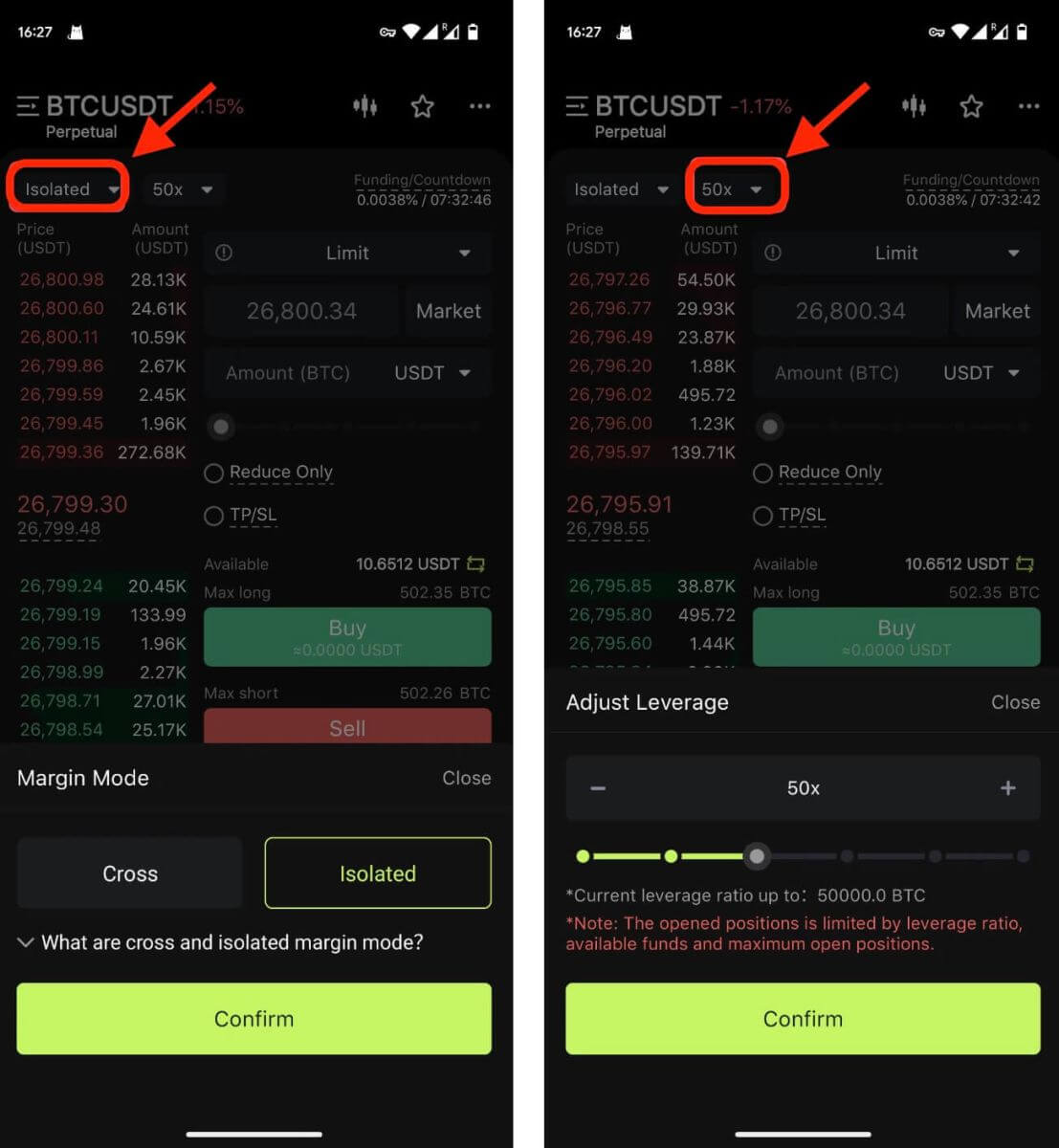

3. Choose the margin mode and adjust the leverage settings according to your preference.

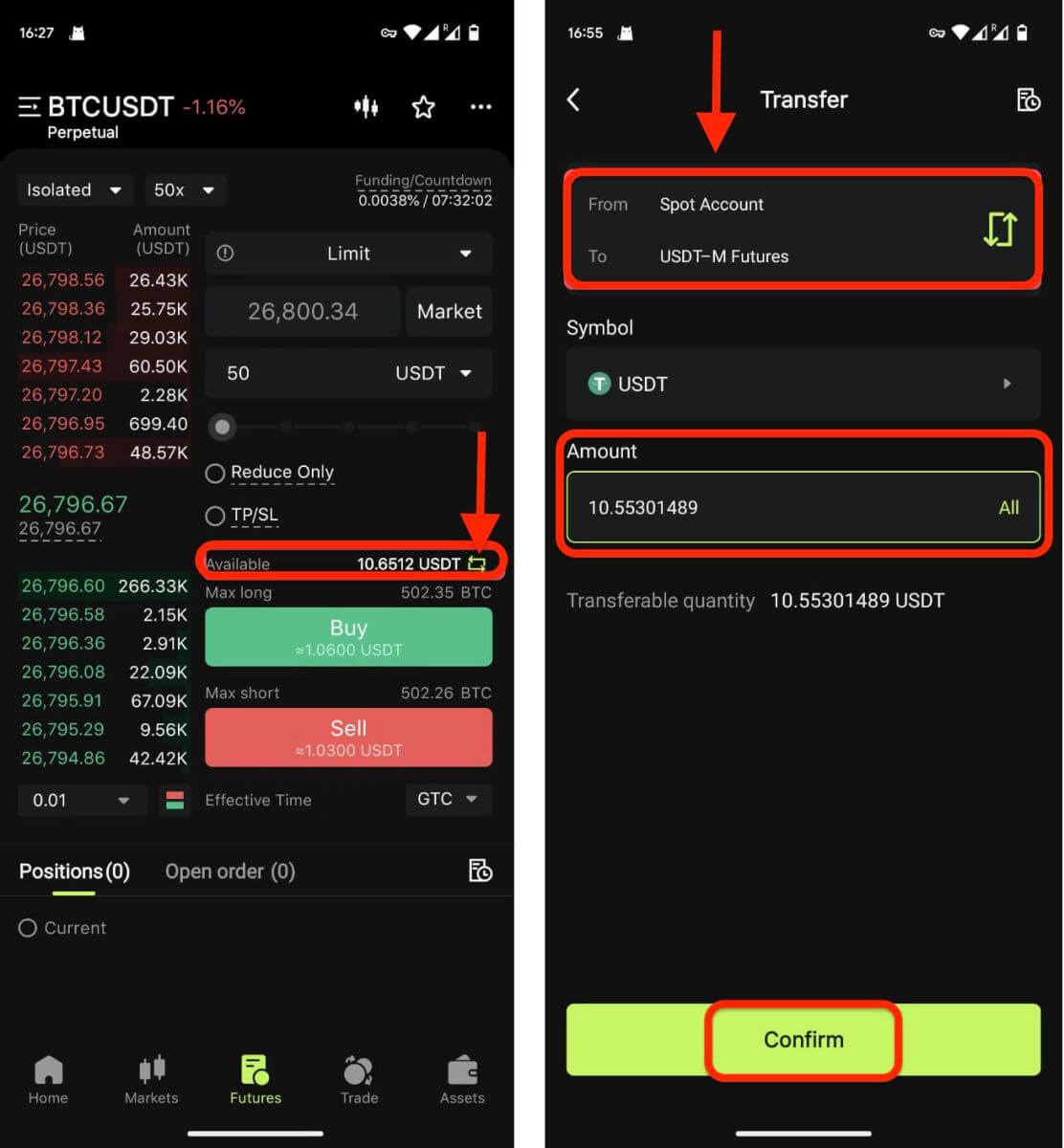

4. Click the arrow icon next to the available balance to transfer funds from your spot account to the futures account.

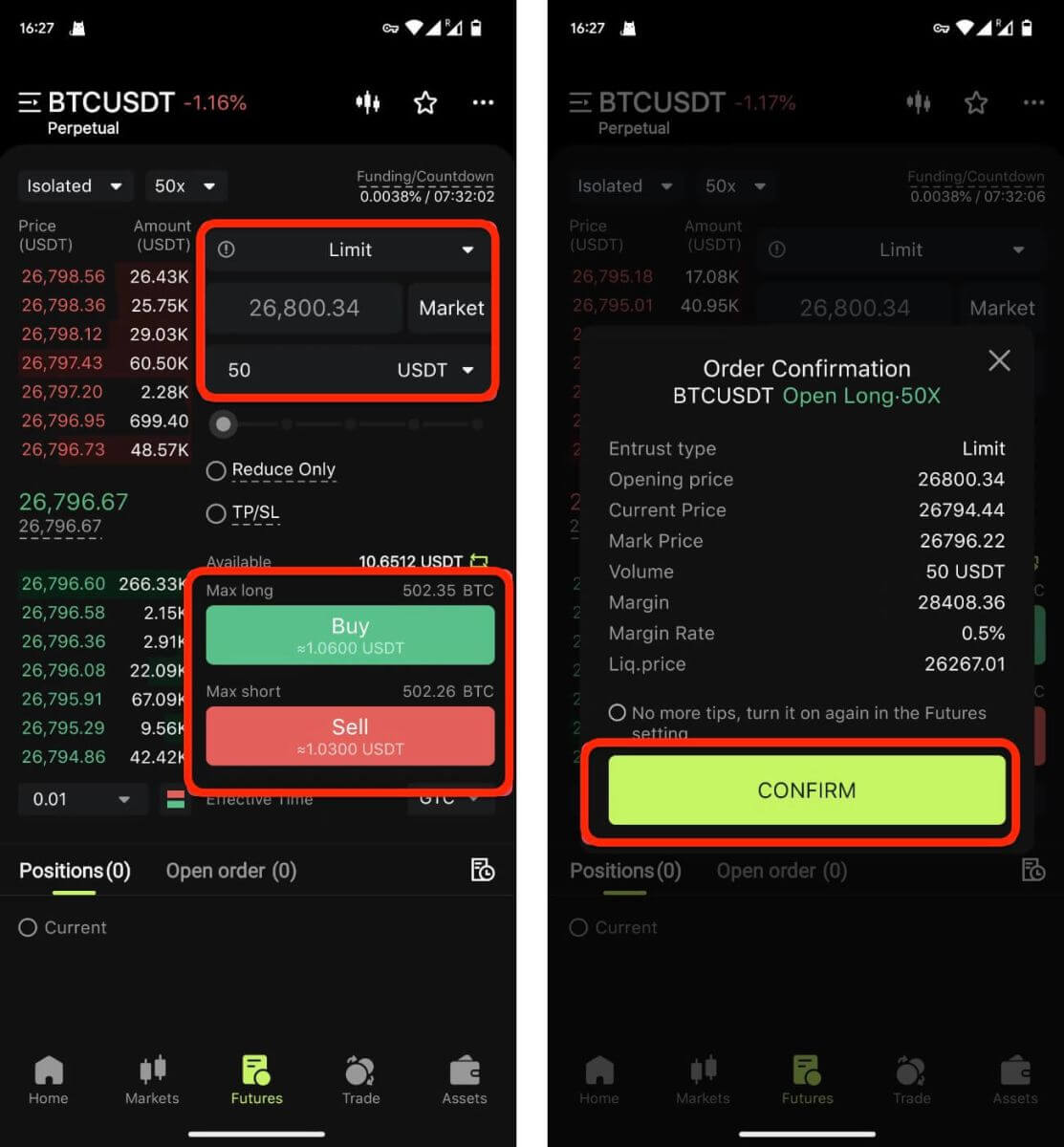

5. On the right side of the screen, place your order. For a limit order, enter the price and amount; for a market order, input only the amount. Tap "Buy" to initiate a long position or "Sell" for a short position.

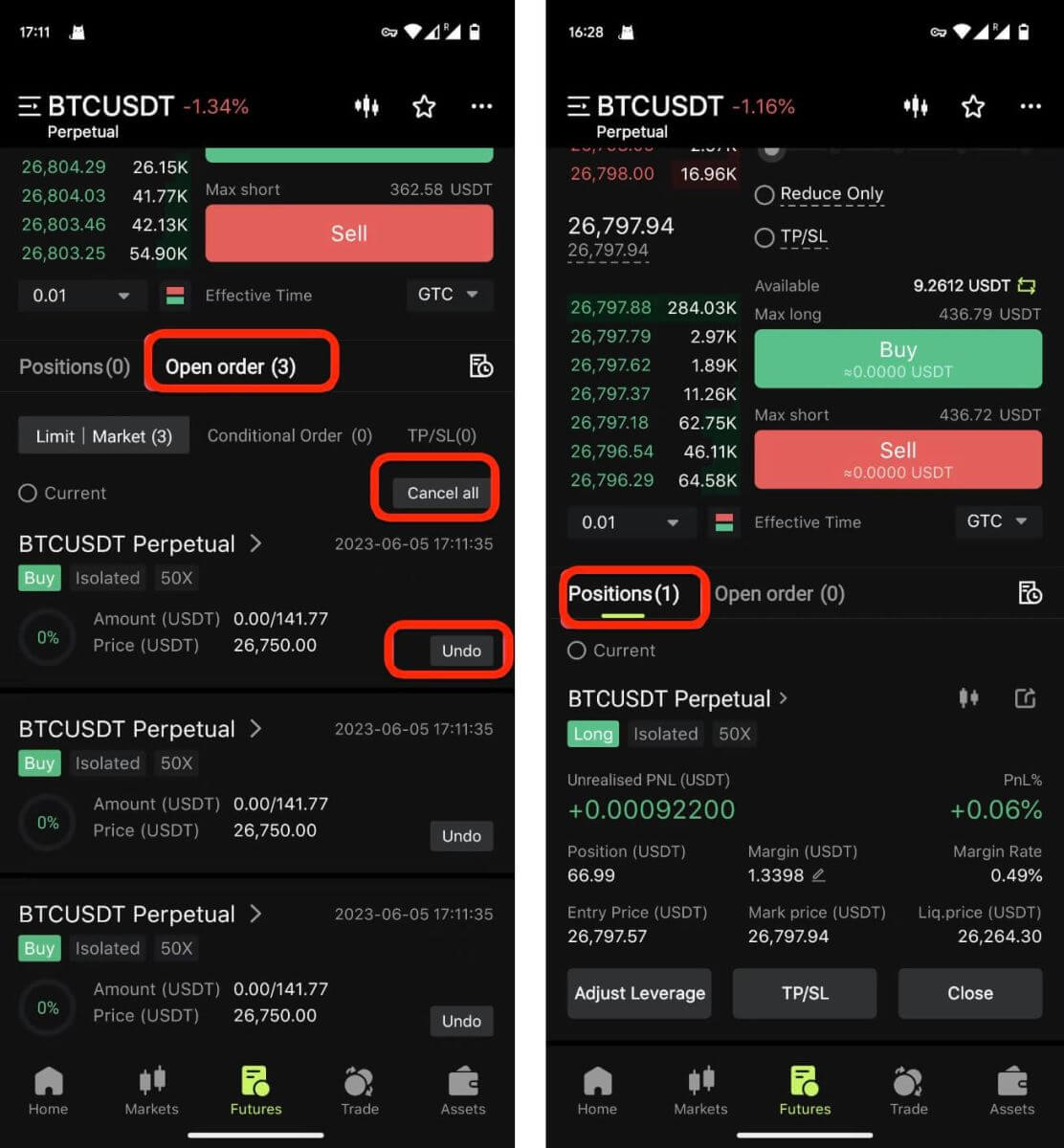

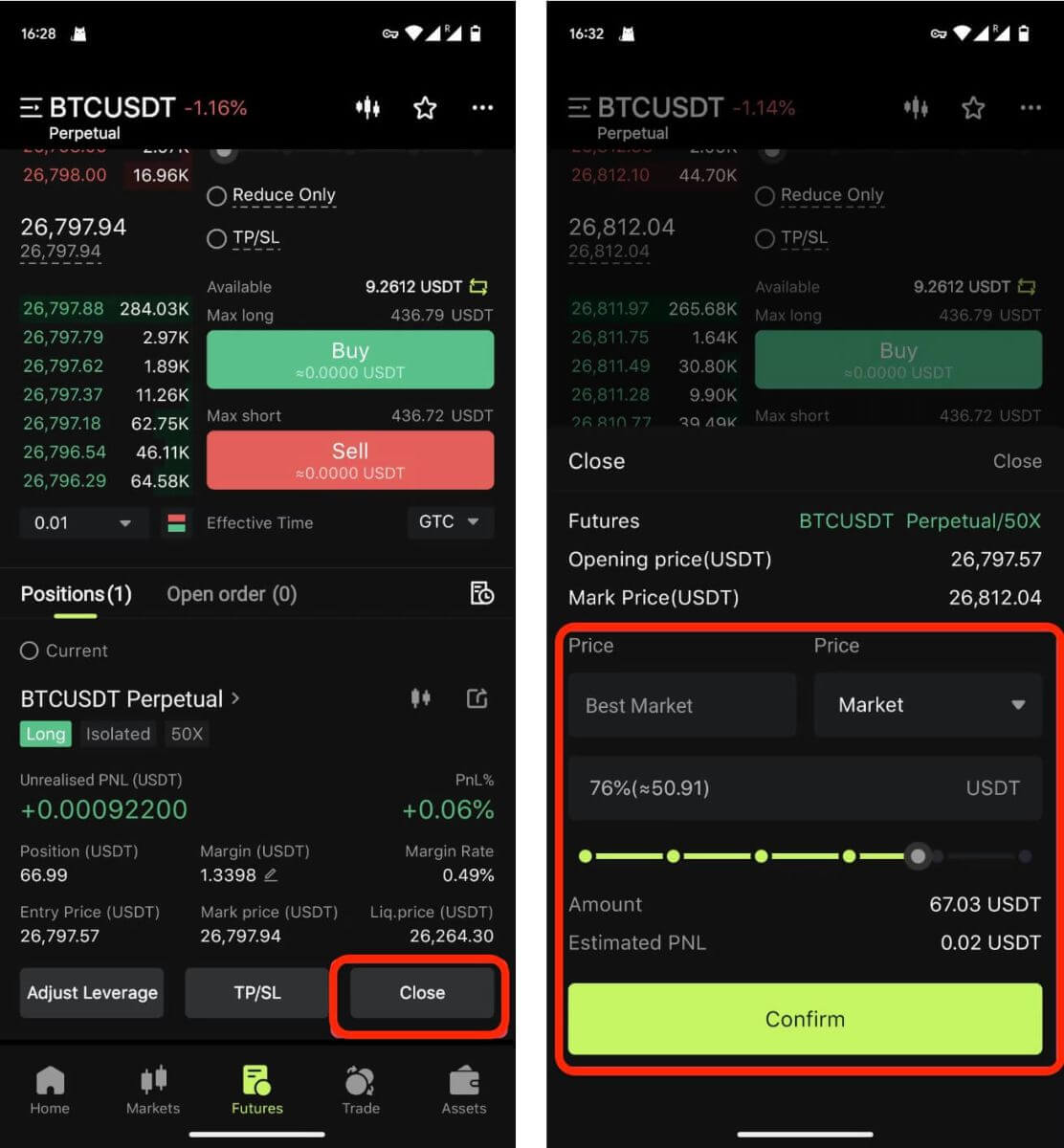

6. Once the order is placed, if it isn’t filled immediately, it will appear in "Open Orders." Users have the option to tap "[Cancel]" to revoke pending orders. Fulfilled orders will be located under "Positions".

7. Under "Positions," tap "Close," then enter the price and amount required to close a position.

Frequently Asked Questions (FAQ)

What is USDT-M perpetual future trading?

A USDT-margined, or USDT-M perpetual future, is a contract with the same quote currency and settlement currency, making it the easiest one with all contract types. It has the same concept as spot trading, which is also the easiest one of crypto tradings to understand.

What is the trading time of the USDT perpetual future?

The USDT perpetual future is a 7*24-hour non-stop trading market.

What are the types of USDT-M perpetual future trading?

There are 2 types of contract trading: Long and Short.

Opening a long position means that users are feeling bullish about the market, and buying a certain amount of contracts. After their order is matched, users will be holding a long position. The position will start to make a profit as the index price goes up.

Opening a short position means that users are feeling bearish about the market, and selling a certain amount of contracts. After their order is matched, users will be holding a short position. The position will start to make a profit as the index price goes down.

What are the leverages that Bitunix USDT-M perpetual future trading supports?

The USDT perpetual future trading supports 1x, 2x, 3x, and even higher leverage. Some trading pairs on Bitunix perpetual futures trading support 125x.For example, when trading the BTC/USDT perpetual future with a leverage of 20x, users only need to have 10 USDT as the margin and they can open more/open BTC contract positions with a maximum value of 200 USDT to gain more profits.

Users need to choose their leverage before opening their positions. After opening the position, if there is a position or a pending order, the user cannot switch the current leverage of the contract.

Notice

- Only the contracts that are open for trading can change leverage;

- If there is a pending order or a trigger order set, the leverage cannot be changed;

- If changing the leverage makes the available margin of the account less than 0, the leverage cannot be changed;

- If changing the leverage makes the available margin rate less than or equal to 0, the leverage cannot be changed;

- The changing of leverage may not always be successful. It may fail because trading of such pairs is disabled, status, insufficient guarantee assets, network, system, etc.